Do you know more than half of fire occurrence happens in residential premises (52%)? There were a total of 935 fire incidents that occurred in residential premises (private and public) in 2022.

Source: Singapore Civil Defence Force, Annual Statistics 2022 Report

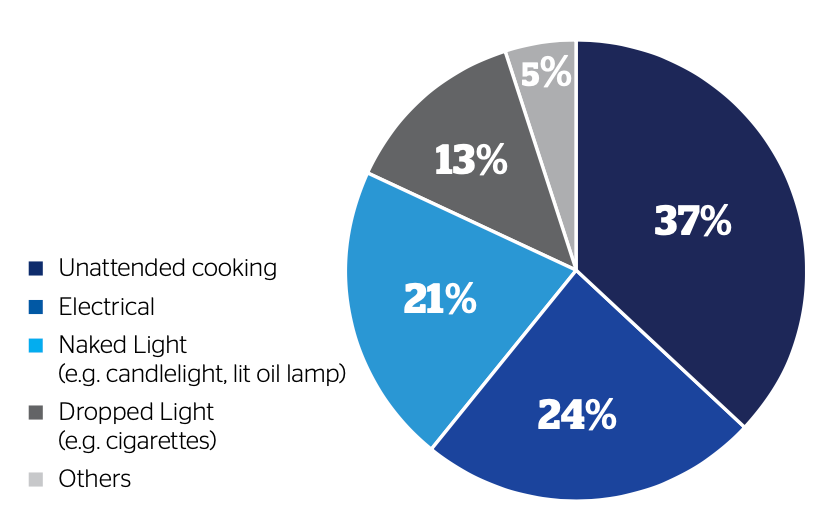

Breakdown of the causes of fires in residential buildings (2022)

Source: Singapore Civil Defence Force Annual Statistics 2022 Report

Source: Singapore Civil Defence Force Annual Statistics 2022 Report

Recent residential fire events:

- Fire in Bedok North flat claims 3 lives, including that of 3-year-old

- 50 residents evacuated after fire breaks out at Toa Payoh flat

- About 80 residents evacuated and 1 taken to hospital after flat near Mountbatten Road catches fire

- Residents evacuated after fire breaks out at East Coast Road

Source: CNA & The Straits Times

What is HDB Fire insurance vs Home insurance?

- HDB requires flat owners who have taken HDB loans to buy and renew HDB fire insurance for their homes as long as they have an outstanding loan.

- HDB Fire insurance lasts for 5 years and home owners have to renew the insurance every 5 years until the loan is fully paid. The sum insured is dependent on the type of flat.

- HDB Fire insurance covers the cost of reinstating damaged internal structures and fixtures and areas built and provided by HDB.

- However, HDB fire insurance does not cover home contents such as renovations, furniture, domestic appliances, computers, clothes, watches, jewellery, sofa, paintings and other personal belongings. For such home contents, home owners can choose to purchase home insurance from various insurance companies.

- Most fire and home insurance policies provide building and structured coverage from damage caused to a home by factors like fire, lightning, domestic explosion, or the bursting or overflowing of water tanks.

Top 3 causes of household fires (source: Singapore Civil Defence Force)

- Unattended cooking

- Electrical

- Naked Light (e.g. candlelight, lit oil lamp)

Tips to fire-proof your house

- Do not use the phone or watch TV when cooking. Set alarm timers to turn off the stove.

- Keep appliances including the stove top, cooker hood and oven clean and free from grease, and in good working condition.

- Do not overload power outlets by plugging in multiple electrical equipment and appliances

- Buy approved original products for items such as battery chargers, batteries and extension sockets. Look for “Safety” mark on plugs and switched socket outlets.

- Ensure there are no flammable materials near devices that are charging. Do not overcharge the devices.

What to do when a fire breaks out

- Leave your house immediately to an open area

- Call 995 (SCDF ambulance and fire service) immediately

- Check on the health condition of your household members and seek medical assistance if necessary

- Inform your insurance agent/broker

QBE Home Insurance Policy

- Covers contents on a first loss basis up to S$200,000

- Premium as low as S$100 annually and pegged to your housing type

- Worldwide personal liability of S$5,000,000

- Option to cover your personal effects on unspecified items on a single limit

Find out more about QBE Home Prestige Package

This article was originally published by QBE Insurance (Singapore) Pte Ltd