It is interesting that people will spend so much, and even acquire loans for buying a car in Singapore. This happens even when Singapore boasts of the most well-connected public transport in the world.

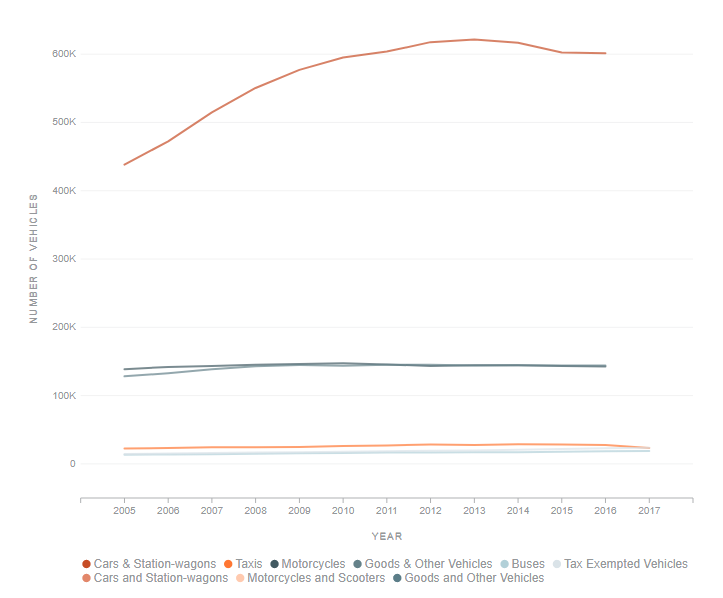

Vehicle Population Statistics

According to the Land Transport Authority’s vehicle population statistics, cars and station-wagons are the majority. Of these many cars and station-wagons, private vehicles make up the most significant number.

In 2017 alone, there were 612,256 total cars and station-wagons. Interestingly, 82% of that number were private vehicles.

The statistics further suggests that private car ownership has been falling year-on-year since 2013. That year recorded the highest number of privately owned cars registered by the Land Transport Authority.

Source: DATA.GOV.SG

Therefore, the statistics indicate that you are most likely to buy a car. However, before you decide to go for that Toyota Corolla Altis, consider the following factors.

What is your Budget?

Cars in Singapore can cost five to six times as much the rest of the world. Therefore, your budget is the first thing to consider before going for that car.

Mainly, getting your budget right will help you gauge if you can afford a PARF or COE car. A Preferential Additional Registration Fee (PARF) car is a bit more expensive compared to Certificate of Entitlement (COE) car.

Luckily, there are instalment plans by various car dealers through which you can afford your car.

PARF or COE?

After buying a car in Singapore, the government requires you to register it and obtain the COE. All new cars carry a price tag of the original cost of production.

Technically, this is the open market value (OMV) of the vehicle. Such cars are eligible for PARF rebate on de-registration. However, this has to happen within the first ten years.

Notably, the PARF rebate is a percentage of the OMV. As such, such cars are quite expensive.

On the other hand, you could opt for the cars that are older than ten years. Technically, these are second-hand vehicles using a renewed registration. Fortunately, such vehicles are very pocket-friendly as people consider them of lower quality due to age and usage.

If it is a COE car, you should consider the extent to which it is used. Doing this will help you to have an idea of how long it will serve you before developing age-related mechanical problems.

How to Finance the Car

As mentioned, cars in Singapore are quite expensive. Therefore, it is essential to have a financing plan at hand before going for the car.

Fortunately, car dealers have financing plans where you can pay a down payment and complete the rest via instalments. However, it is important to that the law caps the instalment value at 70% of the car’s OMV. This is to say that if you wanted a car worth $90,000, you would need to leave a down payment of $27,000.

How do you Obtain Registration for your Car?

The government requires registration for all cars to get a sense of the vehicle population. This also helps in determining the amount of carbon released into the air by the vehicles.

To register your car, you will need the certificate of entitlement (COE). You can obtain the COE via a bidding process that takes place twice every month. However, your preferred car dealer can bid for the COE on your behalf.

Costs of Operating the Vehicle

There are usually additional costs after settling registration and acquiring the car. You will have to consider the various vehicle insurance plans available and which suits you better. Further, there is the road tax.

If you settle for a COE car, ask if the seller already settled the road tax for that year. This is because tax is annual.